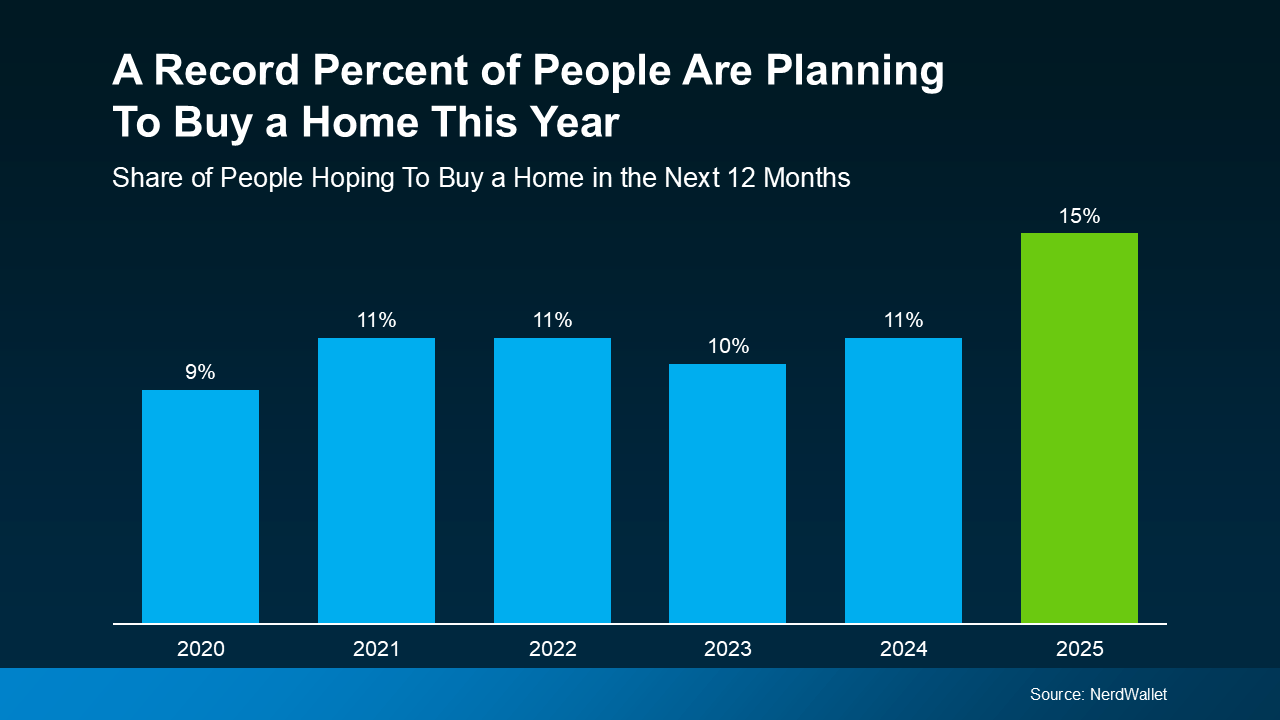

Our markets have taken a downturn, and I expect downward pressure to persist at least through the 4th quarter. This, however, presents a great opportunity for homebuyers who have been waiting for more favorable terms and better pricing. As the economy slows, interest rates should ease, providing further benefits for homebuyers. Now is the time to act or prepare—waiting for the perfect moment to time the market could mean missing out. Once the market begins to turn around, the window of opportunity will close quickly.

To remain competitive, sellers must be prepared to offer concessions and stay flexible on price, especially if the property isn’t show-ready or in a prime location. The days of listing high and expecting multiple offers are behind us, at least for now.

“Since the housing market peaked in June of 2022, many of you may not be fully aware of where the key statistics stand today.”

These are the housing stats for May of 2022, which was the top in the market:

Monthly Average Sales Price per Sq. Ft. May 2022: $303.55

Monthly Median Sales Price- May 2022: $475,000

And these are housing stats for April of 2025: Today

Monthly Average Sales Price per Sq. Ft. May 2025: $299.30

Monthly Median Sales Price May 2025: $445,000

Price Per Sq Ft is down -1.4% in 3 years.

Median Sales Price is down -6.3% in 3 years.

Because the luxury market has remained strong, with significantly higher price points, price-per-square-foot figures can be misleading. The monthly median sales price offers a more accurate and balanced view of the overall housing market.

“Feel free to reach out anytime—it’s more important than ever to work with an experienced agent who can help you confidently navigate today’s challenging market.” Shawn

Here is the……

Market Summary for the Beginning of May

Here are the basics – the ARMLS numbers for May 1, 2025 compared with May 1, 2024 for all areas & types:

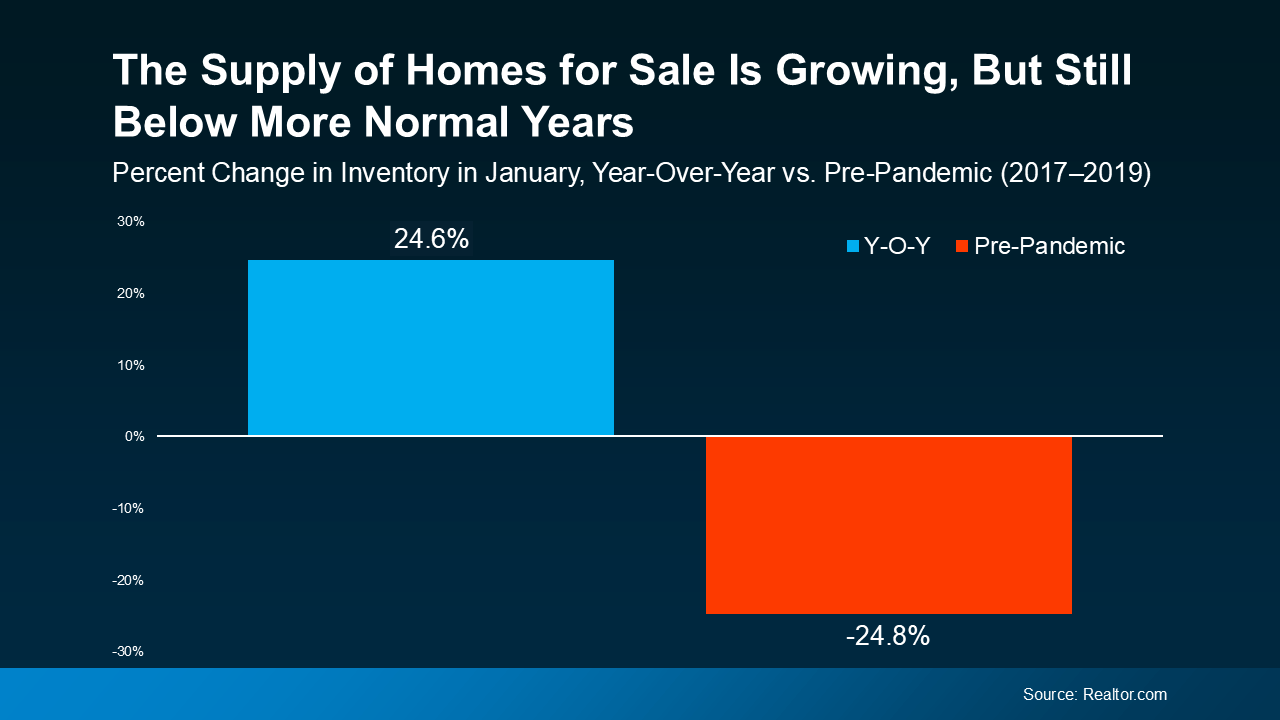

Active Listings: 26,190 versus 17,129 last year – up 53% – and up 4.8% from 24,990 last month.

Under Contract Listings: 9,047 versus 9,336 last year – down 3.1% – and down 0.7% from 9,113 last month.

Monthly Sales: 7,303 versus 7,045 last year – up 3.7% – and up 4.89% from 6,967 last month.

Monthly Average Sales Price per Sq. Ft.: $299.30 versus $306.53 last year – down 2.4% – and down 3.7% from $310.76 last month.

Monthly Median Sales Price: $445,000 versus $450,000 last year – down 1.1% – and down 3.2% from $459,500 last month.

There were 22 working days in both April 2025 and April 2024, so we do not need to make any calendar-based adjustments.

Transaction volumes improved, with closings up 3.7% compared with April 2024. However dollar volume declined, because closed pricing dropped hard between March and April. There are three factors behind this….

Higher volumes at the lower end of the market.

The top end of the market has slowed down.

A general downward trend in prices due to buyers taking increased control of the market.

Supply continued to climb throughout April but the growth rate is slowing down as we enter May. Supply is now a little higher than normal while demand is far below normal. This is not a healthy combination and market theory postulates that prices will fall while the condition persists.

Although sales volume improved, the number of listings under contract has declined slightly from the beginning of April. In theory, demand should increase as prices decline, but that depends on buyers having confidence that home prices won’t get more attractive if they wait a little bit longer.

Temperatures will soon be entering their peak period in Central Arizona and house hunting in the open air will become less comfortable. In almost every year that means the market slows down and prices weaken. The current closing price dip of over 3% during a single month is unlikely to be reversed in the next 4 or 5 months. It is more likely that the downtrend continues, at least until we enter the fourth quarter.

The most positive trend right now is the increase in transaction volumes, and we hope this will continue for some time. Source Cromford Report

Sellers are currently negotiating and, on average, are offering concessions. It’s essential to market your home effectively by ensuring it is move-in ready and presents well. This is not the time to overprice your home, as buyers have many more options available to them.

I can assist you in selling your home, using our proven marketing strategy and resources to prepare your home for the market and ensure it sells for top dollar.

Call me to discuss your situation if you’re considering selling or buying.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link