The October jobs report came in at 150,000, below expectations of 180,000. It was a resilient but moderating job growth number that signifies easing wage pressure.

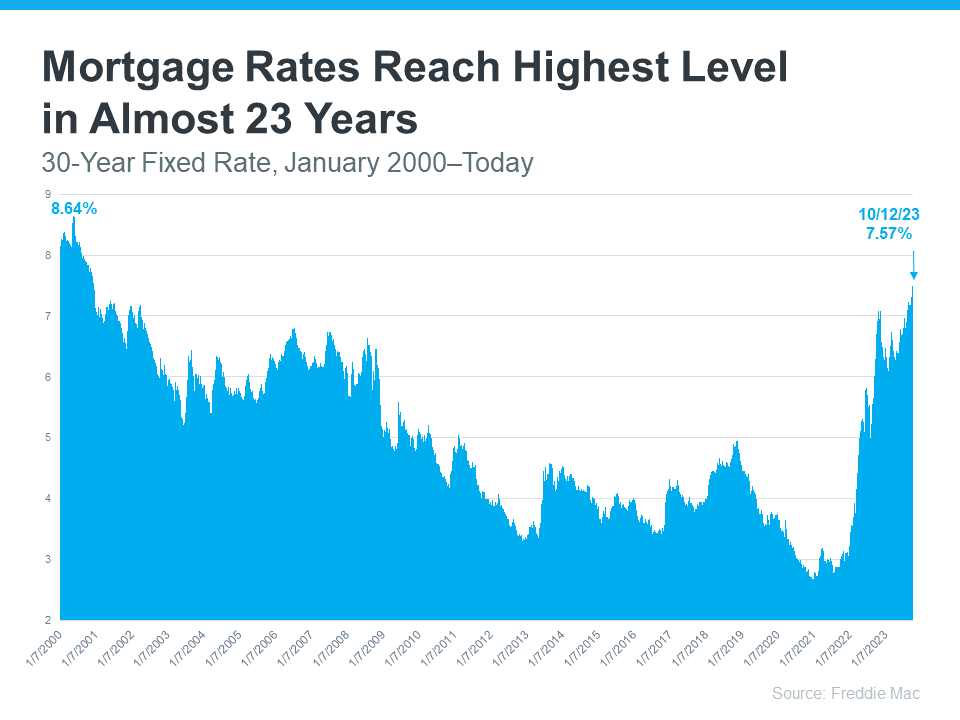

As a result, the 10-year Treasury bond surged like a meme stock, causing the 10-year yield to drop to about 4.56% from 4.9%. This move shows how quickly interest rates can come down and how quickly prices can get bid up once the market turns. The quick decline in the 10-year bond yield has me speculating of further declines in mortgage rates in 2024. The average 30-year fixed-rate mortgage declined from about 8% to 7.35% in under two weeks. That’s amazing, volatility for sure.

If mortgage rates do decline by another 1%+ (mid 6%) by Spring 2024 and the stock market stays around current levels or higher, I expect a lot of real estate demand to come off the sidelines and buy. At that time, if you identify a house you really want to buy, good luck getting it because everybody else will want it as well. Will this happen? I’m thinking it will.

Currently in this housing market we’re seeing more price reductions and cancellations. Inventory continues to build month to month and homes under contract continue to decline month to month, creating a more balanced market with sellers NOT having the “upper-hand”.

Market Summary for the Beginning of November

Here are the basics – the ARMLS numbers for October 1, 2023 compared with October 1, 2022 for all areas & types:

- Active Listings: 15,247 versus 20,582 last year – down 26% – but up 14% from 13,404 last month

- Under Contract Listings: 6,028 versus 6,578 last year – down 8.4% – and down 7.2% from 6,499 last month

- Monthly Sales: 5,177 versus 5,420 last year – down 4.5% – and down 5.4% from 5,472 last month

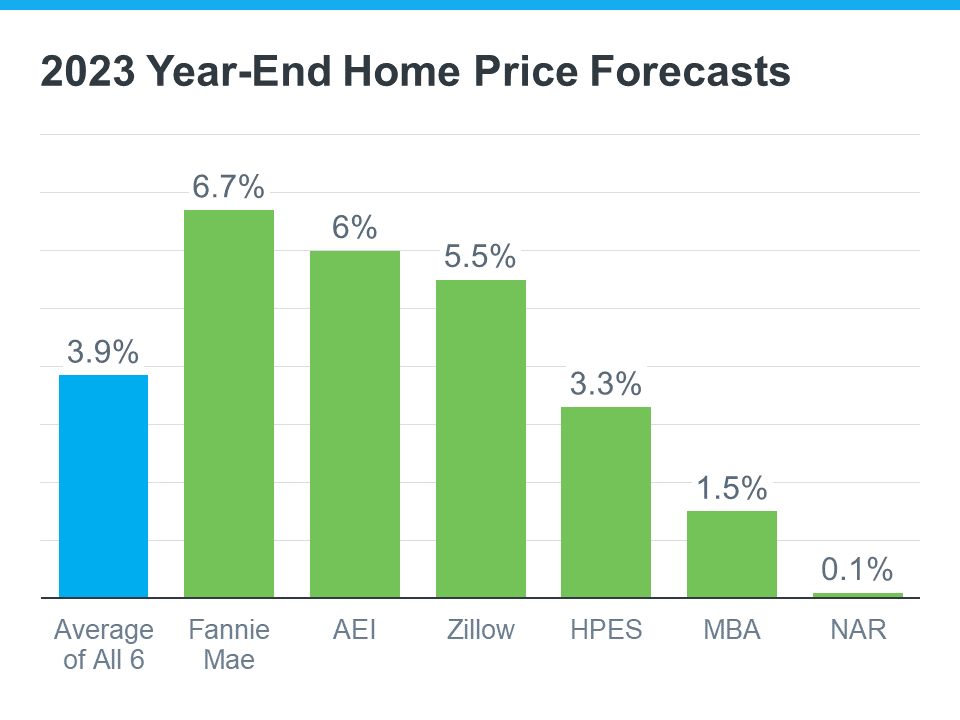

- Monthly Average Sales Price per Sq. Ft.: $295.19 versus $276.73 last year – up 6.7% – and up 3.4% from $285.40 last month

- Monthly Median Sales Price: $435,000 versus $436,000 last year – down 0.2% – but up 0.7% from $432,000 last month

Mortgage rates rose yet further during October, peaking at an average of 8.03% on October 19 and remaining around 7.9% until the end of the month. This had a chilling effect on demand and the pending listing count dropped below 4,000, an unusually low level for the time of year. Monthly sales were also weak at 5,177, even lower than the poor level of a year ago.

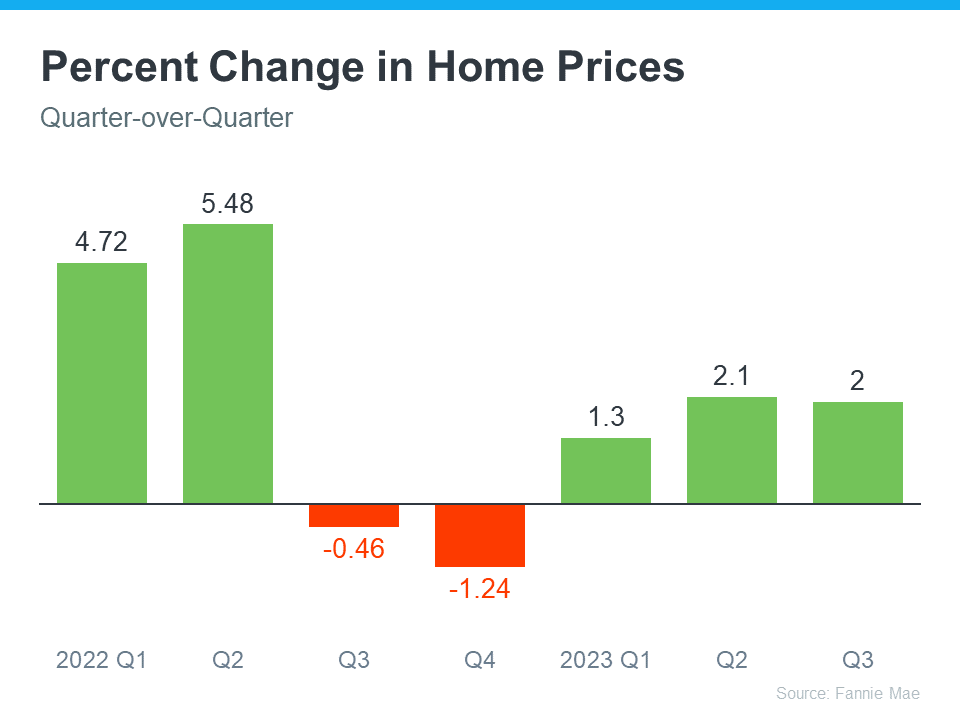

New listings have been arriving at more normal levels over the past 3 months, leading to a rise in active listings, though we are still well below the levels we experienced 12 months ago. Rising supply and falling demand have led to a significant change in the state of the market and the seller’s market is quickly becoming more balanced, with a few areas becoming favorable to buyers instead. This has not been reflected in the average closed price per sq. ft. which shot up by 3.4% over the last month and is now 6.7% higher than a year ago. However, the median sales price is much less impressive, still slightly below last year’s level and up only 0.7% for the month.

An absence of pain can sometimes be experienced as pleasure, like when you stop banging your head against a wall. This principle applies to the Federal Reserve who decided NOT to raise the Federal Funds Rate at the start of November. The mortgage market had a huge party in response. The average 30-year fixed rate dropped from 7.88% on October 31 to 7.38% just 3 days later. The lower rates may possibly result in a recovery of demand during November, but the change was too late to be reflected in any of the numbers above.

Demand remains surprisingly robust in the new home market, which has benefited from the weak supply in the re-sale market. New home pricing has increased much faster than re-sale pricing as a result. Offering mortgage rate buy-downs has been an important factor is maintaining this demand.

We now must watch the demand numbers to see if buyers respond to rates under 7.5%. Source, Cromford Report

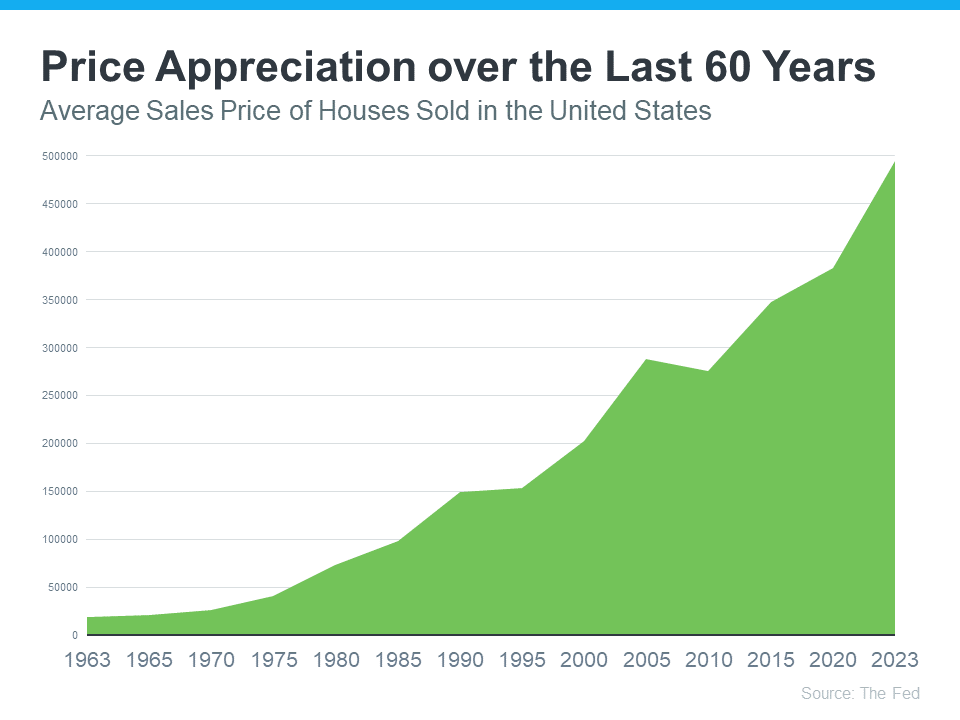

Arizona is ranked second among states where home prices are rising faster than wages. Arizona’s housing price and wage growth disparity over the last five years stands at 37.7%. The U.S. housing market is no stranger to volatility, and housing affordability continues to remain a significant concern for aspiring homeowners waiting on the sidelines as home prices rise and mortgage rates increase. Read the article here: Arizona ranks No. 2 among states where home prices are rising faster than wages – AZ Big Media

Go to my website for information and a special feature called “Neighborhood News” “the best way to stay connected to what’s happening in the real estate market in your area”. Also, you can search real time listings in any area of the market. Check it out and stay updated with my daily blog and monthly market report that I send out monthly. My Website–Find Your Dream Home

If you’re considering selling or buying, give me a call to discuss your situation and current market conditions.

The best compliment is a referral to your family and friends!

Shawn Keane

shawn.keane@azmoves.com

Cell: 602-989-3209

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link